Introduction

In the dynamic world of Indian mutual funds, hybrid schemes have emerged as compelling options for investors seeking a balance between growth and stability. One such intriguing code floating in the investment ecosystem is mutf_in: sbi_equi_hybr_vuwazq—a designation that may appear cryptic at first, but it represents an actively managed hybrid fund from SBI Mutual Fund, one of India’s most trusted asset management companies.

This article aims to decode mutf_in: sbi_equi_hybr_vuwazq, examining what it stands for, its portfolio composition, target investor profile, and its potential role in wealth-building. If you’re an investor seeking diversification, moderate risk, and capital appreciation, this deep dive will offer both clarity and strategy.

What Does mutf_in: sbi_equi_hybr_vuwazq Mean?

The term mutf_in is commonly used as a prefix to mutual fund schemes listed in investment APIs or fund aggregation platforms in India. It stands for “Mutual Fund – India.”

The remainder—sbi_equi_hybr_vuwazq—breaks down as follows:

- sbi: Indicates the fund is managed by SBI Mutual Fund.

- equi_hybr: Abbreviates Equity Hybrid, signaling a balanced asset allocation between equity (stocks) and fixed-income instruments (bonds/debt).

- vuwazq: An alphanumeric code used internally or by aggregators to uniquely identify this specific hybrid scheme.

Put simply, mutf_in: sbi_equi_hybr_vuwazq refers to a hybrid mutual fund from SBI that combines equity and debt to offer both capital appreciation and income stability.

Understanding Hybrid Funds: The Strategic Middle Path

Before diving into this specific fund, it’s essential to understand hybrid funds. They are designed to give investors the best of both worlds—the high-return potential of equities and the risk-buffering capabilities of debt instruments.

Types of Hybrid Funds:

- Aggressive Hybrid Funds: Typically invest 65–80% in equities and the rest in debt.

- Balanced Hybrid Funds: Maintain a 40–60% allocation in both equities and debt.

- Conservative Hybrid Funds: Hold more debt than equity, suitable for risk-averse investors.

Based on the “equi_hybr” tag in mutf_in: sbi_equi_hybr_vuwazq, this scheme most likely belongs to the aggressive or balanced hybrid category, striking a tactical allocation that favors long-term capital growth with some safety net from fixed-income instruments.

Portfolio Composition and Asset Allocation

Though the exact details of mutf_in: sbi_equi_hybr_vuwazq may vary over time due to active fund management, SBI’s equity hybrid funds generally follow a structured pattern:

1. Equity Allocation (60–75%)

- Blue-chip stocks: Reliance Industries, Infosys, HDFC Bank

- Mid and small-cap exposure: For added alpha and growth

- Sector diversification: Including IT, Pharma, Banking, FMCG

2. Debt Allocation (25–40%)

- Government securities (G-Secs)

- AAA-rated corporate bonds

- Money market instruments for liquidity

This composition is curated to allow growth through equities, while also absorbing market shocks via fixed-income holdings.

Fund Objectives and Strategy

The overarching goal of mutf_in: sbi_equi_hybr_vuwazq is to provide long-term capital appreciation with a secondary focus on generating regular income. Here’s how it aims to achieve that:

- Active Stock Picking: SBI Mutual Fund’s research-backed approach allows fund managers to rotate sector weights based on macroeconomic conditions and corporate earnings outlook.

- Dynamic Rebalancing: Asset allocation is regularly reviewed to maintain optimal equity-debt ratios depending on market volatility.

- Interest Income Buffering: The debt part of the portfolio cushions against downside risk, ensuring NAV (Net Asset Value) stability.

This makes the scheme attractive for investors who want more than a fixed deposit but are hesitant to dive into pure equity waters.

Who Should Invest in mutf_in: sbi_equi_hybr_vuwazq?

This fund is not for everyone, and that’s exactly why it works well for specific investor categories:

Ideal Investors:

- First-time mutual fund investors who want moderate exposure to equity

- Retirees or conservative investors seeking balanced returns with lower volatility

- Young professionals with long-term investment horizons but low risk tolerance

- Salaried individuals planning for medium to long-term goals like home purchase or children’s education

Given its hybrid nature, this scheme is especially effective in Systematic Investment Plan (SIP) formats where rupee cost averaging mitigates the impact of market fluctuations.

Historical Returns and Performance Metrics

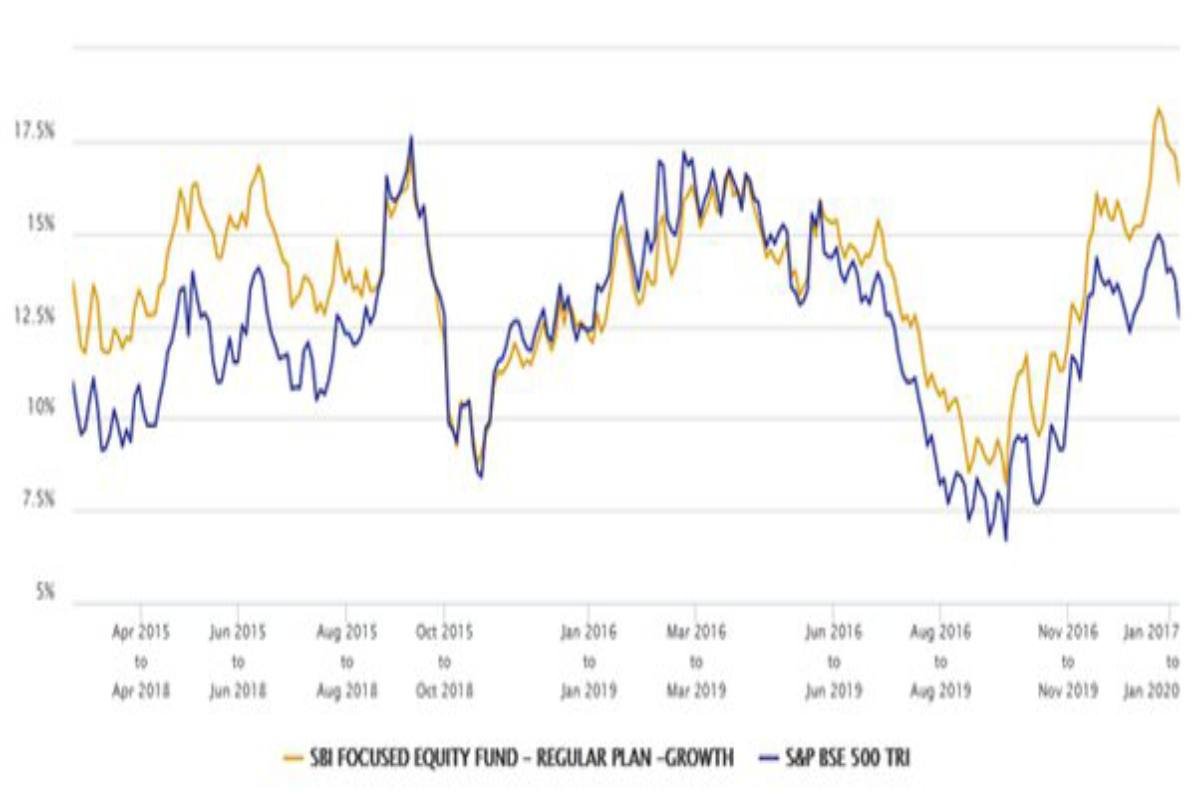

While specific returns for mutf_in: sbi_equi_hybr_vuwazq may differ depending on its inception date and current AUM (Assets Under Management), SBI’s flagship equity hybrid funds have shown the following trends:

- 3-Year CAGR: Between 10–13%

- 5-Year CAGR: Around 12–15%

- Standard Deviation: Lower than pure equity funds

- Sharpe Ratio: Balanced, indicating decent returns for the risk taken

These figures suggest that while not the highest return generators, SBI hybrid funds offer a reliable risk-reward tradeoff.

Taxation Considerations

One of the biggest concerns investors face is taxation. Here’s how mutf_in: sbi_equi_hybr_vuwazq is generally taxed under current Indian laws:

- Equity Component (>65%):

- Long-Term Capital Gains (LTCG) after 1 year: Taxed at 10% beyond ₹1 lakh

- Short-Term Capital Gains (STCG): Taxed at 15%

- Dividends: Added to income and taxed as per income slab (post-2020 amendments)

If the fund has less than 65% equity, it is taxed like a debt fund, with indexation benefits for LTCG after 3 years.

Key Risks to Be Aware Of

No mutual fund is without risk—even hybrid ones. Here are the primary risks associated with mutf_in: sbi_equi_hybr_vuwazq:

- Market Risk: Equity portion is sensitive to market downturns and macroeconomic events.

- Interest Rate Risk: Debt instruments lose value when interest rates rise.

- Managerial Risk: Active fund management means outcomes depend heavily on fund managers’ skill and market timing.

- Liquidity Risk: If a large number of investors exit simultaneously, NAV could be impacted.

It is crucial to read the fund’s SID (Scheme Information Document) and consult with financial advisors before making investment decisions.

Final Verdict: Is mutf_in: sbi_equi_hybr_vuwazq Worth Considering?

In conclusion, mutf_in: sbi_equi_hybr_vuwazq presents a well-rounded investment product for those who desire balanced exposure to growth and security. Its blend of equity and debt gives it a tactical edge in volatile markets, making it a versatile addition to most investor portfolios.

If your goal is steady returns with moderate risk, this hybrid fund may just be the sweet spot between opportunity and caution. As with any mutual fund, patience, discipline, and consistency in investing will determine your success.

So, if mutf_in: sbi_equi_hybr_vuwazq appears in your platform feed or investment advisor’s suggestion list, now you know—this isn’t just a code. It’s a calculated gateway to smarter, hybrid investing.

you may also read: klypernova.